Posted on Thu, 04/14/2016 - 06:32

By Mark Lowey

“This is an opportunity for oil sands companies to be part of the solution to climate change – and to be seen as part of the solution – rather than only being seen as part of the problem,” says David Layzell, Professor and Director of CESAR at the University of Calgary. “Companies can step in and actually clean up Alberta’s electrical grid while they reduce their own emissions.”

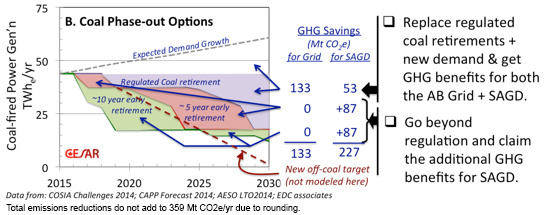

Figure 1. The cogeneration opportunity for the Grid and SAGD operations in Alberta. The expected demand growth in this plot assumes a high oil sands growth future.

Deploying sufficient cogen units at SAGD facilities to allow coal plants to be retired up to 10 years early could reduce 227 million tonnes (Mt) carbon dioxide equivalent ( CO2e) from SAGD operations (Figure 1), plus another 133 Mt CO2e reduced from the electrical grid, for a total reduction of 359 Mt CO2e (Figure 2) between now and 2030, CESAR’s modelling shows. This is a much greater emissions reduction than what would be achieved if the retiring coal plants were to be replaced by natural gas combined cycle plants, the default option that is currently being considered (Figure 2).

Using cogeneration to integrate SAGD operations and power generation for Alberta’s electrical grid, these sectors would consume less natural gas, resulting in lower carbon intensity of both electricity and oil sands crude production. While cogeneration can capture and use more than 80 per cent of the energy in its natural gas fuel, natural gas combined cycle plants are only about 50 per cent efficient. In fact, it is possible with cogen to produce oil sands crude with a GHG footprint equivalent to conventional crude oils, Layzell says.

The province’s GHG emissions in 2014 totaled 264 Mt/yr, but the oil sands have been the fastest-growing source of GHGs in Canada.

Layzell presented the findings of CESAR’s study to the Canadian Heavy Oil Association-Society of Petroleum Engineers annual heavy oil conference, held April 6 in Calgary. Click here for his presentation.

He noted that climate change concerns over GHG emissions from oil sands production have galvanized international opposition to the industry, stalling new pipelines to Canada’s West and East Coasts and to the U.S. Gulf Coast to export oil sands crude. Critics have slapped the “dirty oil” label on Alberta’s main energy product.

“Clearly, a cost-effective technology is needed to reduce the carbon footprint of SAGD production,” Layzell told the conference.

Figure 2. Scenario comparison outlining the combined GHG emissions for the entire Alberta electricity production and the thermal oil sands production (SAGD + Cyclic steam stimulation) in the province over the period 2015 to 2030. Status Quo is continuing coal generation; OTSG is once through steam generation for SAGD.

Being able to produce oil sands crude with GHG emissions comparable to conventional crude could increase public support for new pipelines to export a product that continues to be in demand for transportation fuels, Layzell said. Alberta’s oil sands crude also would be more competitive because it wouldn’t be penalized nationally or internationally for its carbon footprint.

With the Alberta NDP government planning an accelerated phase-out of coal-fired power, while boosting the role for renewables in the electrical grid by 2030 and implementing an economy-wide carbon tax in 2017, new policies will be established over the next six months, Layzell said.

“The time to act is now,” he said. “If we don’t do this, we’re running the risk of essentially being locked in to an inefficient electrical grid for the next 30 years.” CESAR is looking for industry and/or government partners so it can continue to develop its models and explore the technical, environmental and economic implications for the optimal deployment of cogeneration in scenarios that include: (a) low oil sands growth (versus high growth studied to date); (b) full decommissioning of coal generation by 2030; (c) renewable energy providing 30 per cent of retired coal generation; and (d) cogeneration being modulated to provide the backup for intermittent renewable power.

Integrating SAGD with cogen is doable

It is technically feasible to add cogen technology to either existing or new SAGD plants, using off-the-shelf industrial gas turbines and heat recovery steam generators, experts say.“Cogen is a proven technology which is now installed in a number of oil sands projects, including both cyclic steam stimulation and SAGD operations” run by Imperial Oil, Cenovus Energy, MEG Energy and others, said Song P. Sit, a retired chemical engineer who worked for many years in the oil sands industry and volunteers his expert advice to CESAR.

In fact, Alberta has the largest cogeneration capacity in Canada, of at least 4.3 gigawatts equivalent (GWe) – ahead of Ontario’s 2.4GWe.2

Installing cogen in the oil sands “is really an investment decision that depends on many things, including electricity price, transmission capacity, natural gas price, total installed capital costs and other factors,” Sit said.

Manfred Klein, a principal at Ottawa-based MA Klein & Associates and a former chair of the Industrial Applications of Gas Turbines Committee, said it would be more challenging – because of space limitations onsite and already built infrastructure – to retrofit cogen to an existing SAGD plant than to incorporate cogen in a new facility. “But it is possible, if designed properly.”

“The net impact on the province would be very positive,” said Klein, a CESAR associate. “The mixture of renewables and cogen will add overall reliability to the provincial grid, have a very good greenhouse gas profile, and reduce most air pollution in northern Alberta.”

Another advantage with cogen, he said, is that it can help maintain the reliability of Alberta’s electrical grid as more wind- and solar-generated electricity, which is intermittent, is brought online.

Cogen technology includes a gas turbine, in which high-pressure clean air, heated by fuel, provides the output power and the heat. The turbine can be ramped up and down to provide backup power as needed for renewables, Klein said. “You can load-follow the renewables to some extent, depending on whether it’s wind, solar or hydro.” At the same time, the heat recovery system can be adjusted to increase steam output to ensure sufficient steam for the SAGD operation.

CESAR’s study shows that a 33,000 barrel-per-day SAGD operation (which is the ‘typical’ facility that Canada’s Oil Sands Innovation Alliance uses as a reference) would incorporate a cogen unit with an 85-megwatt gas turbine, plus a heat recovery system. This would provide about half the steam required and complement the steam production from conventional boilers. Two turbines and two heat recovery systems would be needed to provide all the steam required.

Alberta’s current oil sands royalty regime can already accommodate investment in cogen for existing and new SAGD projects, Sit said. However, he, Layzell and Klein all say that government incentives, such as through the royalty structure or a reduced carbon tax or recognition for recovering and using otherwise wasted heat energy, would be needed to encourage large-scale deployment of SAGD cogen.

Sit suggests creating a task force that includes industry, government, academics and non-governmental organizations to come up with a plan that benefits all sectors and Albertans. He pointed to a successful model: the National Oil Sands Task Force, formed in the1990s under the umbrella of the Alberta Chamber of Resources, which created the generic oil sands royalty framework still used today.

There are large potential benefits in integrating SAGD with cogen, Sit said. “We will green the power grid and oil sands production, as well as provide backup power for renewable power generation. But it’s a real challenge, and it has to involve all stakeholders to find a solution that benefits all.”

Backgrounder

Figure 3. A ‘Made in Alberta’ climate change solution. With SAGD, Alberta is one of the few jurisdictions in the world that has industries with sufficient heat demand to use all the waste heat associated with thermal power generation.

Ending Alberta’s energy waste

To generate electricity, Alberta currently relies on burning coal and natural gas, which emits more than 46 million tonnes (Mt) of CO2e per year, or more than 11 tonnes per capita, as well as about 200,000 tonnes of harmful air pollution from coal.However, most of this thermal power generation uses technologies that capture only 30 to 50 per cent of the fossil fuel energy in the electricity product. The rest of the energy is lost as heat, being dumped to either the atmosphere or water. In Alberta, this discarded heat added up to 388 petajoules (PJ) per year in 2013 – more than the energy used each year by all residential, commercial and institutional buildings in the province (Figure 3).

The advantage of cogeneration using natural gas is that thermal in situ oil sands operations (SAGD and cyclic steam stimulation) can use the gas turbine heat byproduct to make steam for direct use – making cogen more efficient overall.

Thermal oil sands production currently delivers about 1.1 million barrels of oil sands crude per day. It is an energy- and carbon-intensive technology, with SAGD demanding 227 PJ per year of heat to make the steam in 2013. Under CESAR’s high oil sands growth scenario, SAGD demand is projected to rise to 469 PJ/yr by 2020, and approximately double that amount by 2030. Even today, SAGD steam generation produces about 24 Mt of carbon dioxide per year, or six tonnes for every Albertan. In addition, there is also heat demand for oil sands cyclic steam stimulation, mining and upgrading operations.

Essentially, in Alberta the electricity-generation industry is burning fossil fuels for power generation and ‘throwing away’ about 388 PJ of heat energy a year. At the same time, the SAGD industry is burning more fossil fuels to generate an additional 227 PJ of heat energy a year.

“We’re proposing an eco-industrial cluster where the SAGD industry looks to use its demand for heat to make steam for oil sands crude production, using cogen. At the same time, oil sands companies would reduce their own carbon footprint, while creating a second product – electricity – to sell from their operations, resulting in greening Alberta’s grid,” David Layzell says. “By integrating the SAGD and thermal electricity sectors, we greatly improve the efficiency of our thermal power generation for the benefit of the environment and the economy.”

Cogen’s multiple benefits

Integrating SAGD operations with cogen would reduce the energy systems-level greenhouse gas (GHG) emissions in Alberta more than any other single initiative and at lower cost, while maintaining oil sands production, Layzell says.Simply replacing coal-fired power with combined cycle natural gas-fired turbines will consume more natural gas and produce GHG emissions, albeit lower than with coal, he said. Cogen technology integrated with SAGD – because it can utilize otherwise wasted heat to produce steam – is much more energy efficient, uses “considerably less” natural gas than combined cycle turbines, and produces fewer GHG emissions.

Manfred Klein points out that the overall efficiency of cogen technology, because it can utilize heat, is in the 80-per-cent range, compared with 50 per cent for combined cycle gas turbine systems. “If you can get your energy efficiency in the 80-per-cent range . . . you cannot go wrong with energy systems that are that efficient.” Moreover, he added, cogen emits about 250 kilograms of CO2e per megawatt-hour of power produced (along with a very small amount, 0.5 kg/MWhr, of air pollutants), compared with about 400 kg CO2e/MWhr for combined cycle turbine and 500 kg CO2e/MWhr for simple-cycle turbine. By comparison, coal plants emit about 1,000 kg CO2e/MWhr, along with air pollutants such as sulphur dioxide, nitrogen oxides, particulates and mercury.

Cogen’s benefits are widely recognized. In 2008, cogen accounted for 9 per cent of total U.S. electricity-generation capacity. A study by the Oak Ridge National Laboratory found that increasing that share to 20 per cent by 2030 would lower U.S. GHG emissions by 600 million tonnes of CO2e – equivalent to taking 109 million cars off the road – compared with a “business-as-usual” scenario.3

In Alberta under current regulations, 14 per cent of the existing capacity of coal-fired power generators must be retired by 2019, and 60 per cent by 2030. The Alberta NDP government has proposed accelerating the timeline of this phase-out.

CESAR’s study included five modelling scenarios, based on a reference scenario of high oil sands growth:

- Status quo (continue with coal-fired power);

- Use combined cycle natural gas-fired power to replace coal-fired power under existing regulations;

- Use SAGD-cogen to meet current regulations for retiring coal-fired power;

- Use SAGD-cogen to retire coal five years earlier than regulations require; and

- Use SAGD-cogen to retire coal approximately 10 years earlier.

The scenarios showed that using only combined cycle natural gas-fired power to replace coal would reduce greenhouse gas emissions by 141 million tonnes CO2e by 2030 (Figure 2). In comparison, using SAGD-cogen for regulated coal retirement would reduce GHG emissions by 186 Mt over the same period. However, stepping up SAGD-cogen deployment and using it to retire coal five years earlier would cut GHG emissions by 273 Mt. And using SAGD-Cogen to retire coal 10 years earlier would slash GHGs by 359 Mt (Figure 2).

Figure 4. The GHG Intensity (kg CO2e/bbl) associated with SAGD oil sands crude produced using both the heat and power from a gas turbine. The grey shaded area denotes the range of GHG intensities associated with conventional oil production.

As Alberta, the United States and even China shift from coal to more gas-fired power, the price of natural gas is expected to rise. With cogen, Alberta’s SAGD companies would use less gas per barrel of oil produced and per megawatt of electricity generated, so the cost of gas for producers would be a smaller proportion of their operating expenses. This would provide some protection from increasing natural gas prices.

Cogen also offers the opportunity to significantly reduce carbon emissions from SAGD operations and improve the reputation of oil sands production. It is possible to reduce emissions so they are comparable to, or sometimes even better than, the emission levels associated with various conventional crude oils, Layzell says (See Figure 4).

Part of this benefit is derived from the oil sands crude production side of SAGD operations getting credit for GHG emission reductions that the operations achieve if coal plants are retired in advance of the regulated time schedule. Therefore, these GHG intensity declines would only be temporary, being lost when the early-retired coal plants would have been required to retire. In effect, the accounting mechanism behind Figure 4 provides SAGD operators with an opportunity to invest in five to 20 years of reduced oil sands crude GHG intensities. This also gives them the time to develop transformative new, more environmentally friendly technologies for bitumen extraction and crude oil production.

Global demand for oil to make transportation fuels is expected to continue until at least the mid-century, so SAGD operators with cogen units could produce a crude oil with much lower greenhouse gas emissions intensity to meet this demand. As carbon prices increase in a low-carbon global economy, the oil sands industry would thereby reduce the threat of making their product uncompetitive in national or international markets.

“There is a huge provincial and Canadian benefit to getting that whole carbon footprint profile improved,” Klein says.

Song P. Sit notes that there would also be a big economic benefit for the oil sands industry if, by reducing the carbon footprint of oil sands crude production, they could get one or more pipelines built to tidewater to export their product to the international market. That would lower the differential between the global market price for crude versus the price for now-landlocked oil sands crude, increasing profit for SAGD producers and likely making investment in cogen more attractive.

Cogen also would help oil companies make the shift to be truly energy companies, Layzell says. SAGD operators would have two energy products to sell rather than one, including low-cost electricity. Analysis shows the cost of generating cogen electricity is lower than from virtually all other sources, he says. By deploying more renewables such as wind and solar in concert with specially designed cogen, Alberta could achieve relatively low, stable electricity prices, he adds. Moreover, the province should be able to avoid some of the problems Ontario is facing following the large-scale deployment of renewables in that province.

Figure 5. Sankey diagrams showing energy flows and GHG emissions (Bar charts) associated with two strategies to produce 33,000 Bbl/day of oil sand crude and 550 GWhe/yr of power to the grid. The cogen scenario only incorporates one 85 MW gas turbine. In theory, it should be possible to install two 85 MW gas turbines with duct burning to provide 100% of the steam needed by the SAGD facility envisaged here.

Meeting the challenges

The equipment cost of a cogen unit in a SAGD facility is estimated to be $150 million, ($50 million for the gas turbine and up to $100 million for the heat recovery system and auxiliaries), plus installation and modification costs. However, Layzell argues that it makes more sense for SAGD companies to invest in cogen when the price of oil is $40 per barrel than when it is $100 per barrel. “At $40 per barrel, you’re either not making a profit or losing money,” he says. With cogen, SAGD operators would have another product – low-cost electricity – to sell. And the return on investment could happen fairly quickly, depending on the price of natural gas and electricity.

The equipment cost of a cogen unit in a SAGD facility is estimated to be $150 million, ($50 million for the gas turbine and up to $100 million for the heat recovery system and auxiliaries), plus installation and modification costs. However, Layzell argues that it makes more sense for SAGD companies to invest in cogen when the price of oil is $40 per barrel than when it is $100 per barrel. “At $40 per barrel, you’re either not making a profit or losing money,” he says. With cogen, SAGD operators would have another product – low-cost electricity – to sell. And the return on investment could happen fairly quickly, depending on the price of natural gas and electricity. Sit notes that before SAGD companies invest in cogen, they would want to be confident they’ll get a return on their investment, including being able to sell surplus electricity at a profit. However, some thermal in situ projects that have cogen are selling their surplus electricity now, which suggests that cogen is a viable investment for thermal in situ operations, he says.

With the phasing out of coal-fired power and ramping up renewables to 30 per cent, Alberta will need to build more electricity transmission lines, whether for new cogen power or new renewables. If cogen is widely deployed across SAGD operations, more transmission infrastructure will be needed from the Athabasca oil sands region to carry power south to urban demand centres. However, most of Alberta’s wind and solar resources are in southern Alberta, so bringing more of these renewables onto the grid will require more lines carrying power north.

Layzell acknowledges that the transmission infrastructure issue needs careful study. However, he points out that a new transmission line, the Fort McMurray West 500-kV Transmission Project,4 has been approved to connect coal-fired power plants west of Edmonton to Fort McMurray. The line was originally conceived to bring more electricity to the oil sands region as production expanded and power demand increased. In light of current oil prices and new oil sands projects being postponed or cancelled, that line could be reversed to bring SAGD cogen power south, he suggests. This would offer an option for early adopters – SAGD companies investing in new cogen to provide power to ‘green’ the Alberta grid. Layzell adds that it also may be possible to use some transmission lines that would be available from the phase-out of coal, and to rethink how to use the heavy build-out of transmission infrastructure that was approved under previous provincial governments or is already under construction.

Although it is critical and urgent to find a solution for the large carbon footprint of SAGD production and Alberta’s carbon-intensive electrical grid, Layzell says, “The bottom line is: Is there the political will to change?” Industry, he says, needs to step up and help convince policy makers that the SAGD-cogen approach is a viable strategy, not only to significantly reduce the province’s greenhouse gas emissions but to help stabilize the hydrocarbon industry’s boom-and-bust cycles. Organizations like the Canadian Association of Petroleum Producers and Canada’s Oil Sands Innovation Alliance should lead these discussions with government and other stakeholders.

Alberta’s new economy-wide carbon tax, set to start at $20 per ton in 2017 and increase to $30 per ton in 2018, will target end users and affect the price of gasoline and home heating fuels. Some of the revenue generated by the tax possibly could be used to incentivize the deployment of cogen across SAGD operations, and help shift the province to a more efficient structure for reducing greenhouse gas emissions, Layzell says.

Footnotes

1 CESAR’s high oil sands growth scenario assumed a sustained price of about US$90 per barrel for West Texas Intermediate crude oil, which was projected to drive oil sands production – including with new projects – to more than 5 million barrels per day by 2040, from the current level of approximately 2.4 million b/d.

2 Cogeneration Facilities in Canada 2014. Canadian Industrial Energy End-use Data and Analysis Centre, Simon Fraser University. http://www2.cieedac.sfu.ca/media/publications/Cogeneration_Report_2014_Final.pdf accessed on April 8, 2016.

3 Cogeneration/Combined Heat and Power. Centre for Climate and Energy Solutions. http://www.c2es.org/technology/factsheet/CogenerationCHP accessed on April 8, 2016.

4 Fort McMurray West 500-kV Transmission Project. Alberta PowerLine, an ATCO company. http://www.albertapowerline.com/ accessed on April 8, 2016