Posted on Tue, 03/05/2019 - 06:38

By David B. Layzell PhD, FRSC and Jessica Lof MSc

“…Alberta is in the transportation fuel business [and it] is poised for transformative, potentially disruptive change.”

Concerns about greenhouse gas emissions and air pollution from fossil fuel combustion provide additional major forces for transformative, systems-level change. As of September 2018, 18 countries and more than 16 major international cities have introduced plans to phase out internal combustion engine vehicles and/or introduce incentives for adopting electric vehicles between 2020 and 2040. California and Quebec already have zero-emissions vehicle standards, and British Columbia has mandated a zero-emissions vehicle standard by 2040.1

Electrified, zero-emission vehicles are the greatest challenge to Alberta’s oil industry, and they come in two distinct types:

- Battery electric vehicles (BEVs) that get their energy from the public grid, store it in on-board batteries and use that electricity to power the motors that turn the wheels. Charging can either be carried out while the vehicle is not being used, or with electrified portions of highways while vehicles are moving2.

- Hydrogen fuel cell electric vehicles (HFCEVs) that generate the electricity onboard from hydrogen fuel, allocate some power to temporary battery storage, and draw on both battery and fuel cell electricity to power the motors that turn the wheels.

While BEVs seem to be the technology of choice for smaller, lighter vehicles driving shorter distances, the jury is still out for the best zero-emission technology for freight transport, a sector that consumes about 69% of all diesel consumption in Alberta. Indeed, companies promoting zero-emission trucks are very active in advancing either their BEV or HFCEV vision for the future of freight and some are even working to undermine the competition3.

“…Albertans should care deeply about which technology pathway – battery electric or hydrogen fuel cell electric – ultimately wins in the marketplace.”

Albertans should care deeply about what technology pathway – battery electric or hydrogen fuel cell electric - ultimately wins in the marketplace.

While the province is not well positioned for the production of low-cost, low-carbon dispatchable electricity, it has incredible resources and capacity be a global leader in providing zero-emissions fuels for HFCEVs.

The Economic Opportunity for Hydrogen in Alberta

For more than a year, CESAR researchers, in collaboration with the freight transportation sector, governments and other stakeholders, have been examining various low or zero-carbon energy systems capable of supporting existing diesel markets. Our research shows that Alberta’s best “Plan B” for the future of its oil-based economy is to transition to the production of a clean, more energy efficient, and much more valuable transportation fuel: hydrogen.

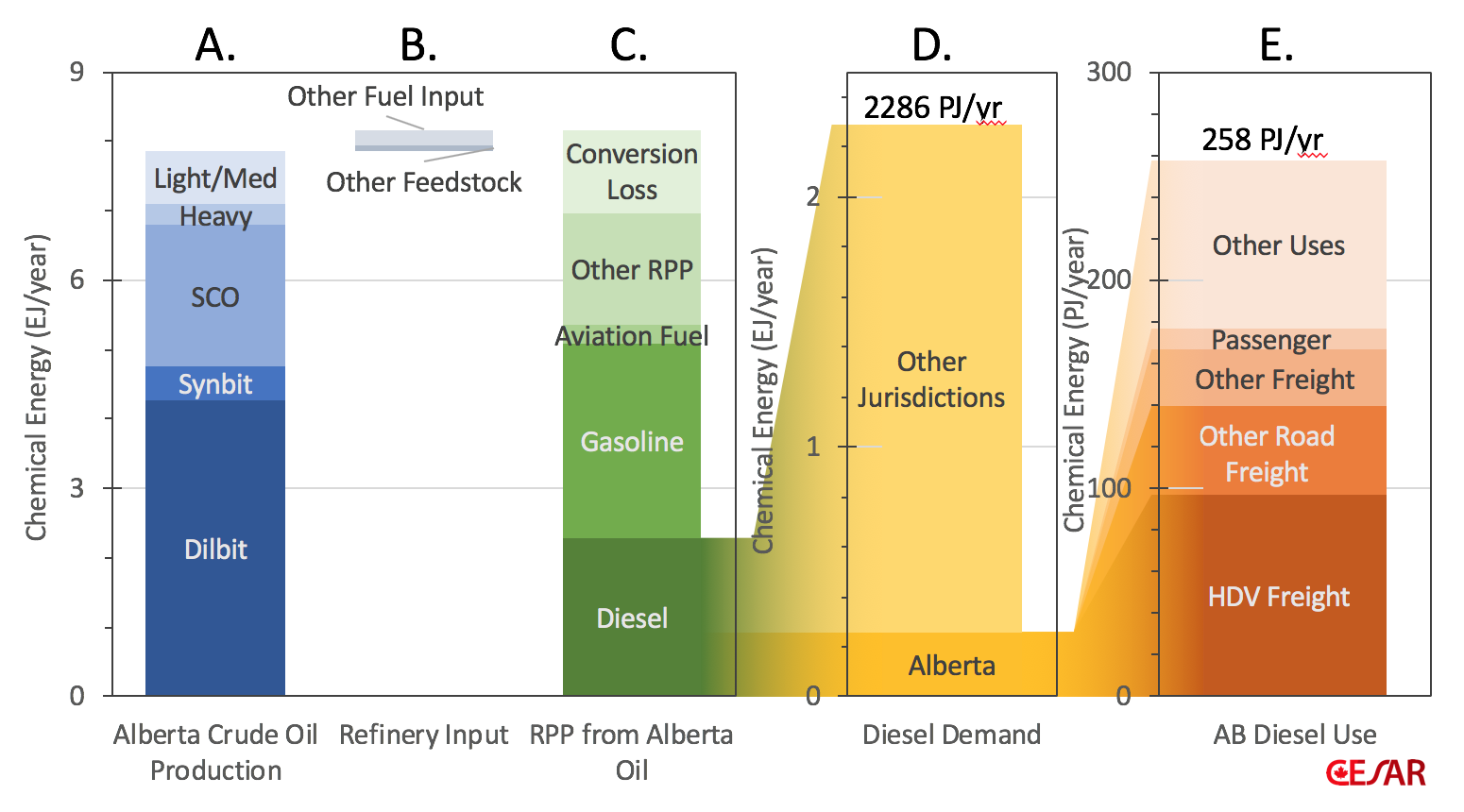

Figure 1. From crude oil production (A) to diesel fuel use in Alberta (E), showing that transportation fuels dominate refined petroleum products (C) and diesel production from Alberta oil is about nine times diesel demand in the province (D). Figure compiled by CESAR with data from the National Energy Board, Alberta Energy Regulator, Energy Information Administration (USA) and Statistics Canada.

In 2016, about 7,900 petajoules (PJ) of crude oil from Alberta were delivered to refineries where 77% of the products were transportation fuels (Figure 1A-C). Of the 2,286 PJ of diesel fuel produced, only 258 PJ per year were consumed in Alberta, the largest portion (97 PJ/yr) by heavy-duty freight transportation vehicles (Figure 1D-E). Therefore, Alberta oil provides about nine times more diesel fuel than the amount consumed in the province.

If there is an energy transition away from diesel to zero-emissions fuel, it would be in Alberta’s economic interest to be able to supply this new market, while continuing to supply oil for the remaining diesel fuel market.

Alberta is already a major producer of hydrogen which is used for cracking hydrocarbons and producing nitrogen fertilizer. Extending the hydrogen market to transportation fuel – especially fuels for heavy duty vehicles where direct electrification is problematic – offers a major new opportunity for economic diversification and business growth, while rebranding the province as a leader in the production of zero-emission fuels. Transitioning to a made-in-Alberta hydrogen economy will enable the province to sell and export a value-added commodity.

“...producing and exporting hydrogen would generate two to four times more economic activity for Alberta then producing and exporting crude oil.”

Alberta oil at has been selling at $4 to $8 per gigajoule (GJ) ($25 to $50 per barrel)4. In a future hydrogen economy, the wholesale price of hydrogen is expected to be $18 to $25/GJ ($2.50 to $3.50 per kg hydrogen). Even if we take into consideration that Alberta would sell less hydrogen energy than crude oil energy to support the same transportation market,5 producing and exporting hydrogen would generate two to four times more economic activity for Alberta then producing and exporting crude oil for the diesel market.

This will not only mean jobs, but the earnings from the production, wholesale and retail sale of hydrogen will contribute to the province’s gross domestic product, royalty and tax revenue.

The Technologies and Sectors Behind a ‘Made in Alberta’ Hydrogen Economy

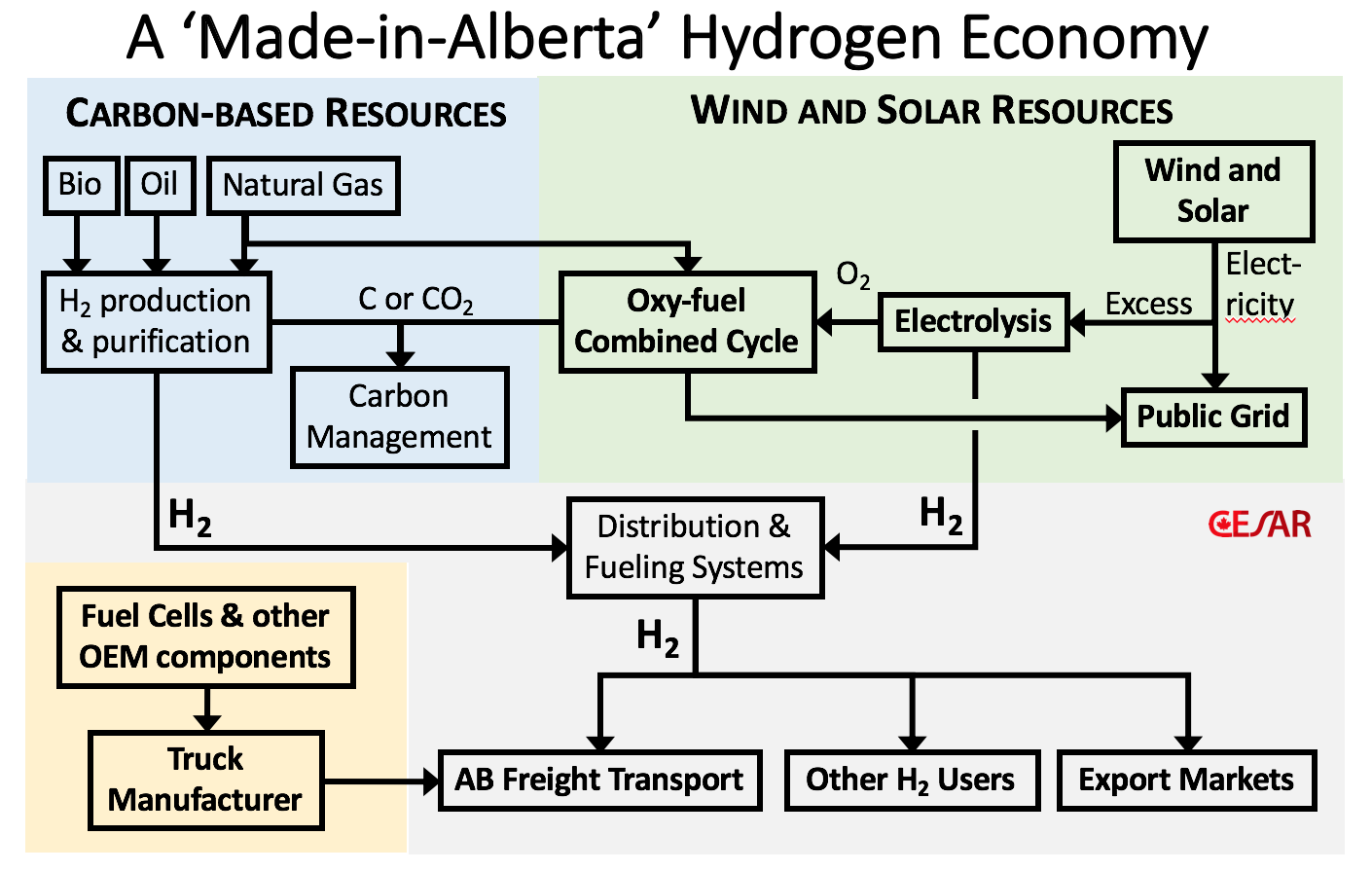

There are many technologies that could be used for the production of hydrogen with minimal or no greenhouse gas emissions to the atmosphere (Figure 2). Some of the top contenders include:

- Steam-methane reforming of natural gas. This mature technology would need to be modified to produce a pure CO2 stream for geological sequestration (i.e. Carbon Management in Figure 2) in addition to transportation grade hydrogen. Using a recent US government study,6 CESAR estimated that the hydrogen could be produced with 90% of the CO2 sequestered for about $10/ GJ hydrogen ($1.42/kg hydrogen), assuming a natural gas feedstock cost of $2.50/GJ. The spread between this price and the $18 to $25 /GJ hydrogen wholesale price mentioned above leaves room for profit, royalties and taxes.

- Gasification of bitumen or biomass.7 In the case of biomass, sequestration of the CO2 byproduct could deliver both negative greenhouse gas emissions and a zero-emission transportation fuel. In the case of bitumen, gasification could even be carried out underground with only the hydrogen being brought to the surface.8

- Electrolysis of water with wind or solar power. Wind and solar generation are rapidly becoming the lowest cost forms of electricity generation.9 When this generation is not needed for the grid, it can be used to create hydrogen and oxygen from water.10 With the option to use surplus power to make hydrogen, it should be possible to oversize wind and solar generation in the province, dramatically reducing the carbon intensity of the public grid while simultaneously generating a zero-emission transportation fuel.

Figure 2. Possible components for a ‘Made-in-Alberta’ hydrogen economy. H2, hydrogen; O2, oxygen; CO2, Carbon dioxide.

“…[for] the production, distribution and use of hydrogen, Alberta has major competitive advantages:

- Vast oil and gas resources;

- Geology for CO2 storage;

- Plentiful wind & solar;

- Superb human resources.”

For these and other technologies associated with the production, distribution and use of hydrogen, Alberta has major competitive advantages compared to other jurisdictions in North America and around the world. These include:

- Vast natural gas and crude oil resources that are valued below U.S. and world-market prices. These can be converted to hydrogen more cost-competitively than most other jurisdictions. Selling value-added hydrogen made from oil and gas for $18 to $25/GJ could be a better business opportunity than selling the feedstocks for $1 to $8/GJ.

- The necessary sub-surface geology that can either use the byproduct of hydrogen production – carbon dioxide – for enhanced oil recovery or to provide a permanent, safe, underground storage site for the CO2;

- Plentiful, low-cost renewable energy resources (especially wind and solar) for electrolytic production of hydrogen. Wind farms are now being built in Alberta that will deliver grid power for less than $40/MWh.11

- Superb technical and human resource expertise and the innovative spirit needed for the safe production and distribution of hydrogen and the creation of a Western Canadian hydrogen economy.

The Time to Act is Now

The electrification of freight transportation is still at an embryonic stage, but the proponents of BEVs and HFCEVs have the attention and interest of the freight transportation sector. Many freight companies are eager to find cleaner, lower-maintenance alternatives to the diesel/ internal combustion engine technology that is currently their only alternative. They are attracted by the torque of electric vehicles and interested in trucks with fewer moving parts that have a longer life with lower maintenance costs. With the eventual introduction of autonomous vehicles and improved logistics made possible by big data, there is a concern that diesel vehicles will hold them back. Give them a credible, compelling alternative, and they will switch.

Freight transportation is the ‘anchor tenant’ in a future made-in-Alberta hydrogen economy. They need to be a key part of a ‘Plan B’ for an Alberta economy that keeps this province in the transportation fuel business. However, the transportation fuel needs to be zero-emission so Alberta can be key part of the solution to both the climate change and air pollution challenges.

In the mid 1970’s, Premier Peter Lougheed established the Alberta Oil Sands Technology and Research Authority (AOSTRA) to unlock the economic potential of the province’s oil sands.12 That initiative led to the development of many technologies, including Steam Assisted Gravity Drainage (SAGD) that have contributed significantly to the economic development of the province in the past 15 to 20 years.

Perhaps Alberta needs an AOSTRA2, but this one could be called AZEFRATA for Alberta Zero Emissions Fuels Research And Technology Authority. Suggestions for alternative names are invited - and clearly needed!

CESAR will be publishing the detailed analysis and modeling work behind this post over the next few months. Register with CESAR if you want to receive a notification as each paper is released.

Acknowledgements

This work would not have been possible without the contributions of the following CESAR researchers: Kyle McElheran, BSc, EIT. Nicole Belanger, BSc. EIT; Bastiaan Straatman, PhD, Song Sit, PhD, Geoff Martin, BSc, Madhav Narendran BSc and Mark Lowey BA.

We are grateful for the financial support of this work that has been provided by the Edmonton Community Foundation, the Ivey Foundation, the Clean Economy Fund, the Transition Accelerator and Alberta Innovates.

Footnotes

1 https://climateprotection.org/wp-content/uploads/2018/10/Survey-on-Global-Activities-to-Phase-Out-ICE-Vehicles-FINAL-Oct-3-2018.pdf

2 https://www.cbc.ca/radio/asithappens/as-it-happens-monday-full-episode-1.4621483/electric-avenue-sweden-builds-a-road-that-charges-your-vehicle-while-you-drive-1.4621485 or https://new.siemens.com/global/en/products/mobility/road-solutions/electromobility/ehighway.html

3 https://www.cnbc.com/2019/02/21/musk-calls-hydrogen-fuel-cells-stupid-but-tech-may-threaten-tesla.html

4 All currency values in this document are in Canadian dollars and the energy values are in gigajoules (GJ) of higher heating value (HHV).

5 This calculation considers that crude oil must be refined to produce diesel, and that hydrogen fuel cells and electric motors are more efficient than internal combustion engines.

6

NREL H2A: Hydrogen Analysis Production Case Studies- Current Central Hydrogen Production from Natural Gas with CO2 Sequestration version 3:

https://www.nrel.gov/hydrogen/assets/docs/current-central-natural-gas-with-CO2-sequestration-v3-2018.xlsm

Comments

colleencollins replied on Permalink

Hydrogen transport

Great work - looking forward to detailed reports. Will they include economic modelling?

Economic Modelling

cspopoff replied on Permalink

ARIS Gen IV potential use

I wonder if the studies performed in conjunction with INL and PTAC investigating the integration of nuclear and petrochemical industries could be used to plug in the Gen IV reactor specs provided by vendors in the ARIS Gen IV reactor database to evaluate producing synthetic combustion fuels instead of leaving hydrogen as the product. Turning over transportation to an EV centric model would require a massive overhaul in infrastructure and hydrogen fuels would be no different. Producing synthetic low GHG or even GHG neutral combustion fuels would address a significant wedge of industrial heat and transport demand (and thus ghg emissions).

Worth exploring

This is certainly a concept worth exploring as we need to consider multiple pathways to a low carbon economy. For the particular example you are proposing, I would want to analyze a number of issues, including:

There may be better ways of putting together the technologies you have proposed. CESAR is involved with a new organizagtion called the Transition Accelerator which may be able to support the advancement of promising pathways. More about that in a future blog post.

rob@airterra.ca replied on Permalink

Completely Resonates

David,

I am delighted to see this vision taking shape.

Is there a way of inviting a larger group of businesses, innovators and investors to get involved?

Rob